In global agri-trade, waiting 30, 45, or even 60 days for payment has long been accepted as “just how the industry works.” Exporters plan around it. Traders absorb it. Suppliers adjust their operations to survive it.

But slow payments are not an inevitability of trade. They are a symptom of a deeper issue: a lack of trust created by fragmented information, manual workflows, and delayed verification.

When quality, delivery, and compliance can only be confirmed after goods arrive thousands of miles away, uncertainty enters every transaction. That uncertainty slows decisions, increases disputes, and puts continuous pressure on cashflow across the supply chain.

The Real Cashflow Problem Isn’t Timing — It’s Trust

Most exporters don’t struggle because buyers are unwilling to pay. They struggle because payment depends on verification that happens too late.

Quality is inspected at destination. Documents are scattered across emails and spreadsheets. Disputes arise because buyers and sellers operate with different versions of the truth. Each gap in information adds friction before invoices can be processed or factored.

In this environment, invoice factoring becomes difficult not because of risk appetite, but because of missing or unstructured data. Without clear proof of what was packed, shipped, and received, every transaction carries uncertainty.

Visibility Must Happen Before Money Moves

To improve cashflow meaningfully, visibility needs to shift upstream — and this is where DiMutoClear plays a critical role.

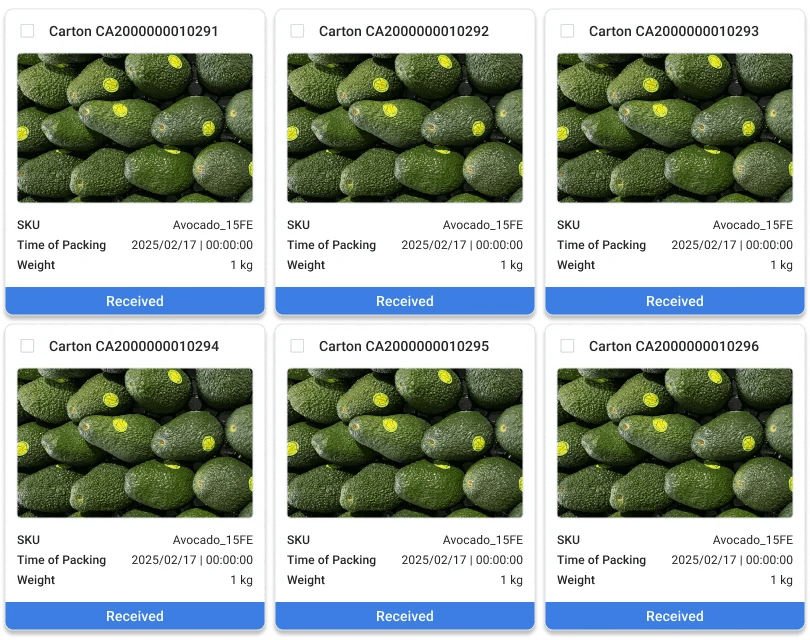

DiMutoClear captures and structures trade data at the source, before goods move and before payment decisions are made. Quality inspections, carton-level images, shipment milestones, and buyer acceptance are digitized in real time, creating a shared and verifiable record across the trade.

Instead of reconstructing events after arrival through emails or informal channels, exporters and buyers reference the same trusted data in the DiMutoClear platform from the moment goods are packed. This early visibility reduces uncertainty, prevents disputes, and removes the friction that typically delays invoice factoring.

By using DiMutoClear as the visibility layer, trust is established before money moves.

Image of an avocado trade being digitised and tracked on DiMutoClear

Turning Trade Data into Predictable Cashflow

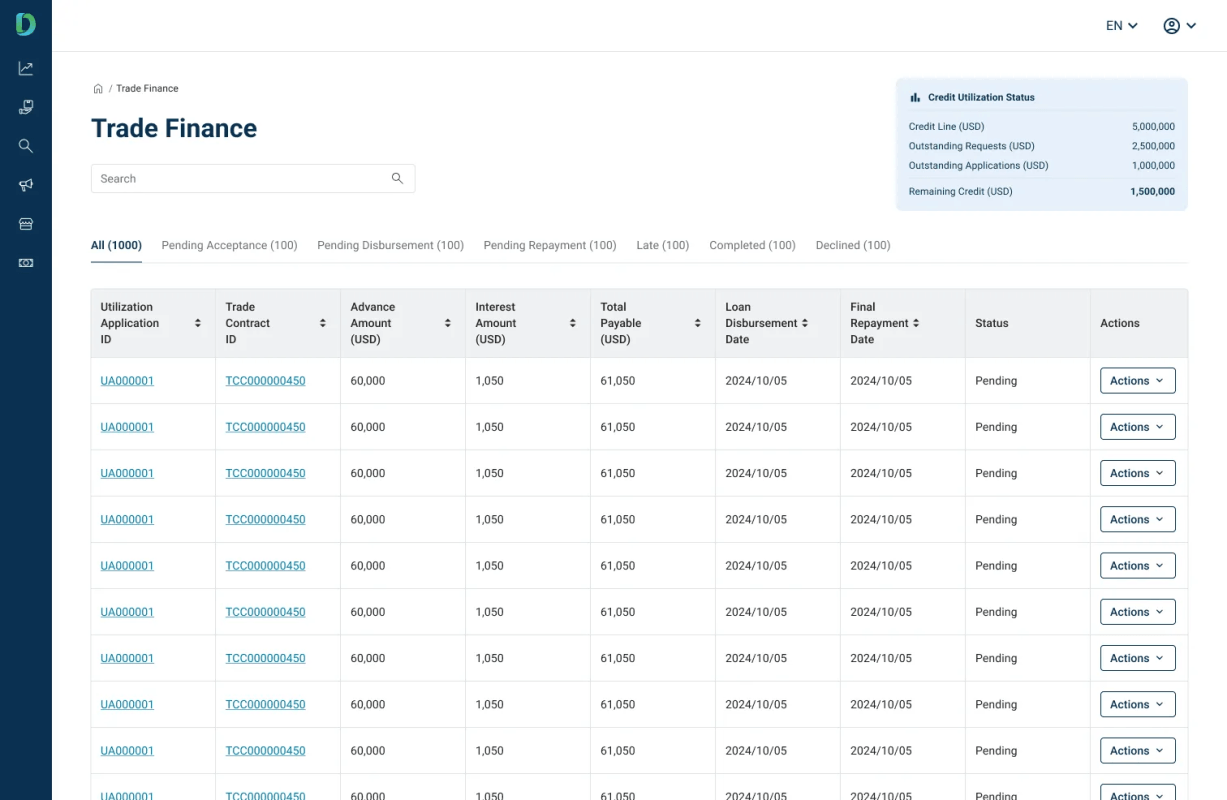

DiMutoPay builds on the data from DiMutoClear to improve cashflow through invoice factoring triggered by verified trade events.

Rather than waiting 30, 45, or even 60 days for post-arrival confirmation, exporters can receive payment in as fast as 48 hours once key milestones — such as quality verification or buyer acceptance — are met. Processing fees are transparent and predictable, replacing opaque delays with clear, data-driven workflows.

The result is not just faster access to funds, but better cashflow planning. Exporters gain predictability. Traders reduce negotiation cycles. Both sides spend less time resolving disputes and more time executing the next shipment.

Image of trade financing recorded and processed on DiMutoPay

Reducing Disputes by Replacing Opinion with Data

Disputes often arise when evidence is incomplete or fragmented. Emails get lost. Photos are disputed. Timelines are unclear.

By centralizing QC images, documents, and timestamps in one platform, DiMuto replaces back-and-forth with objective proof. Buyers and sellers reference the same verified records, reducing disagreements over condition, timing, or responsibility.

Fewer disputes mean fewer delays — and fewer delays directly improve cashflow velocity.

Scaling Trade Without Scaling Complexity

As exporters build a history of digitized trades, more transactions become eligible for invoice factoring. Strong trade records support repeat transactions and enable consistent, rules-based access to improved cashflow.

This scaling happens without increasing operational complexity. The same data that supports traceability also supports payments, allowing exporters to grow volume without multiplying administrative burden.

Modern Trade Requires Modern Rails

Improving cashflow in agri-trade doesn’t require rewriting contracts or forcing radical change overnight. It starts by making trade execution verifiable.

When trust becomes data-driven, payments move faster. When visibility improves, disputes decrease. And when trade data is structured and shared, cashflow becomes predictable instead of reactive.

This is what modern agri-trade looks like — not just faster payments, but a system where visibility, execution, and cashflow move in sync.

If you’re ready to improve cashflow by making your trades verifiable from the start, DiMutoClear and DiMutoPay are built for you.

👉 Reach out to [email protected] to see how data-driven visibility can unlock smoother, faster trade execution.