Unlock Faster Financing and Strengthen Your Cash Flow with DiMutoPay

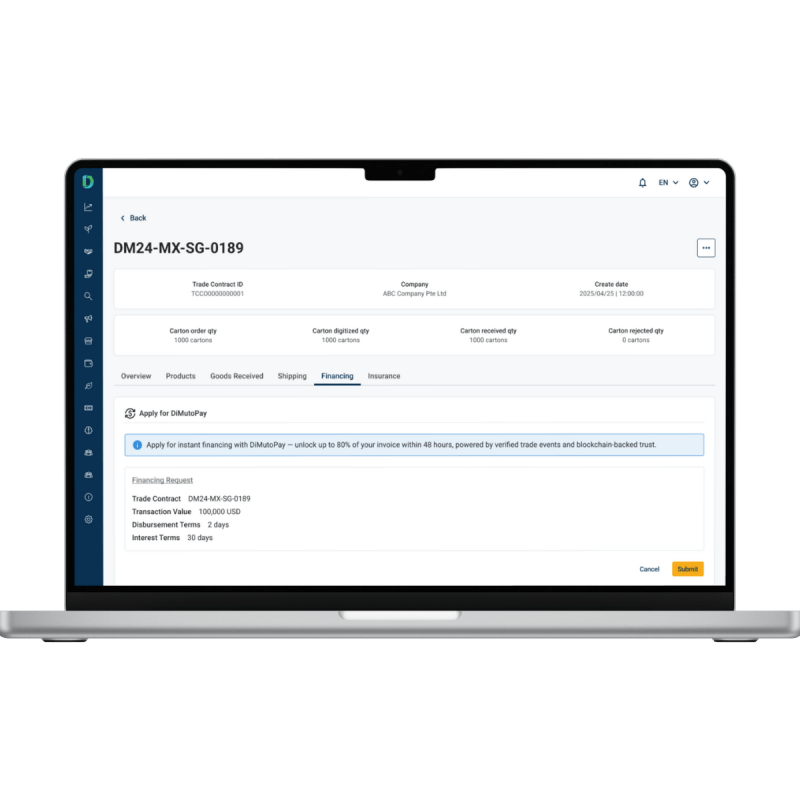

Turn completed trades into instant liquidity with DiMutoPay, our post-clearance financing service. Integrated directly into the DiMuto platform, DiMutoPay converts verified supply chain events such as packing, shipping, goods received, and buyer’s receipt into immediate access to working capital.

Exporters can access up to 80% of invoice value within days instead of waiting 45–60 days. By leveraging blockchain-verified trade data and Trade Health Scores, DiMutoPay provides secure, reliable financing that helps you improve cash flow, reduce financial risk, and grow your business with confidence.