AgriFood businesses face significant challenges when it comes to accessing the funding they need to grow and succeed. According to a report by the International Finance Corporation, there is an estimated US$4.7 trillion funding gap for SMEs globally. This gap is particularly acute in developing countries, where businesses often lack access to traditional sources of financing such as bank loans. The lack of access to funding can significantly hinder the growth of these businesses and limit their ability to contribute to their local economies.

Such issues are further exacerbated in the AgriFood industry due to the unpredictable nature of agriculture and food production. Factors such as weather, disease, and market fluctuations can significantly impact crop yields and food prices, leading to potential losses for businesses that rely on these products. Additionally, the AgriFood industry is often subject to strict regulations and safety standards, which can increase the cost of production and reduce profit margins. This can make it difficult for businesses to generate sufficient revenue to pay back loans and financing, increasing the risk for lenders.

To assess these risk, banks and other financing platforms tend to rely on a business’ historical financial documents. However, assessing such documents may not be a reliable way to judge the risk of financing a company as they may be altered, forged, or irrelevant to their current operations. However, with the right financial solutions and risk management strategies in place, it is possible to minimize these risks and support the growth and success of AgriFood businesses.

Minimising Financing Risks with DiMuto’s AI Generated Trade Health Assessment

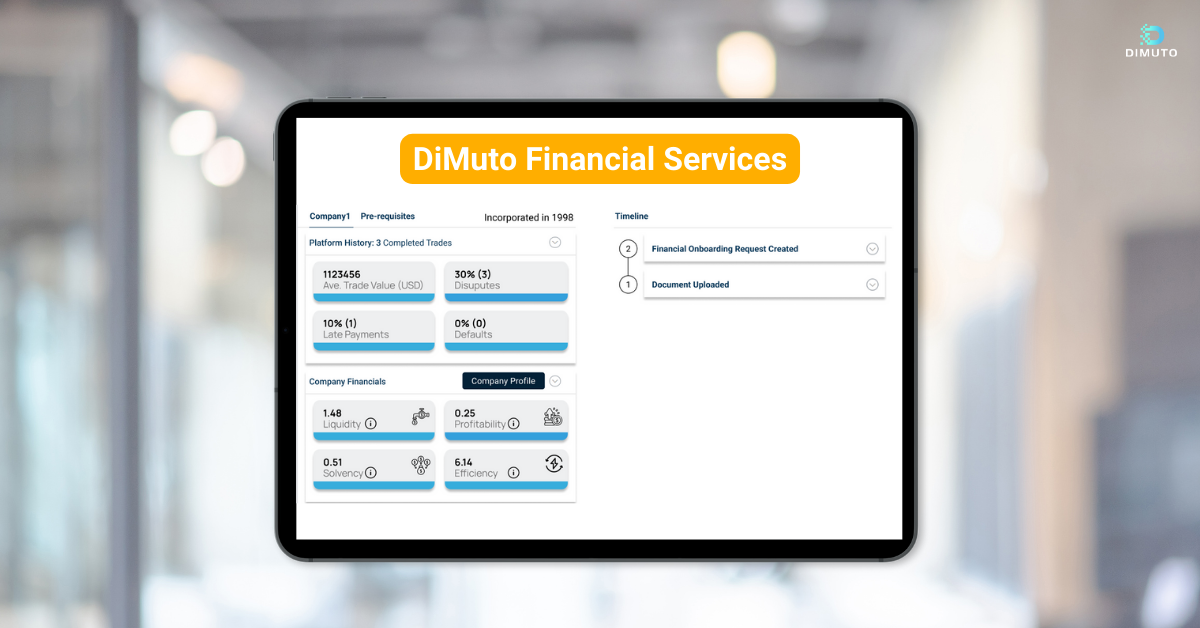

Image: View of Trade Health & Financial AI Screen on DiMuto Platform

DiMuto Financial Services leverages AI to assess trade health and product quality for every trade transaction on our platform, providing Agrifood business and financiers with:

Visibility of day-to-day operations

A complete & accurate image of the financial & operational strength of the company

Low-risk lending for financiers, opportunities for buyers/suppliers

Such analyses can be made not only based on the real-time trade data of each trade that is captured on the DiMuto Platform, but also the collection of such granular data over time per trade relation. In combination with DiMuto’s Product Quality AI, DiMuto can generate a financial risk score for each trade and company that can be used for financing opportunities. Thus, DiMuto’s Trade Health & Financing AI allows for financiers to enjoy deeper visibility and more robust assurance and for borrowers gain more accurate risk assessments and more flexible terms.

Accessing Trade Financing Opportunities with DiMuto

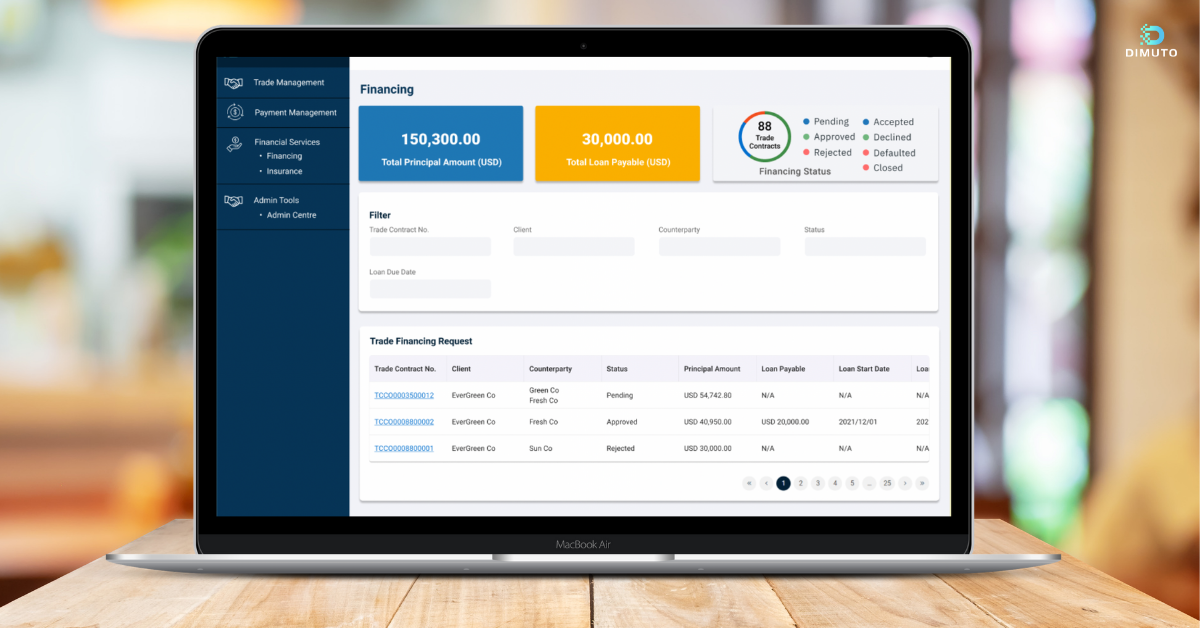

Image: View of Trade Health & Financial AI Homepage on DiMuto Platform

DiMuto’s Financial Services can be a game-changer for businesses looking to improve their cash flow and grow their operations. With post-shipment financing, purchase order financing, and invoice financing, businesses can access the necessary resources to continue their operations, pay their suppliers, and invest in their growth. By providing businesses with 20-30 days of improved cash flow, DiMuto can help them take advantage of growth opportunities and achieve their full potential in the competitive global market.

Post-shipment financing enables businesses to obtain financing for the goods that have been shipped to their customers but have not yet been paid for. This service provides businesses with the necessary cash flow to continue their operations while waiting for payment from their customers, which can take anywhere from 30 days to 60 days, depending on payment terms and customer type. Typically, larger retailers offer payment terms of weeks upon product arrival. By offering post-shipment financing, DiMuto enables AgriFood businesses to pay their suppliers, cover their production costs, and invest in their growth.

Purchase order financing assists businesses in fulfilling their purchase orders, helping them improve their cash flow and meet the demands of their customers. This, in turn, can help businesses build better relationships with their customers and grow their businesses over time. With DiMuto’s purchase order financing, businesses can also get the necessary resources to invest in their growth and development.

DiMuto’s invoice financing service provides businesses with financing based on their outstanding invoices, allowing them to obtain working capital without having to wait for payment from their customers. With invoice financing, businesses can access the funds they need to cover their expenses and invest in their growth, even if their customers take longer than usual to pay their invoices.

DiMuto Financial Services are designed to support the growth and development of businesses within the supply chain. By providing businesses with the necessary financing solutions, DiMuto helps to improve the efficiency and effectiveness of the supply chain, ultimately benefiting all participants within it. If you’re a business looking to improve your cash flow, DiMuto Financial Services could be an excellent solution for you.

A Need For Digital Transformation of Agrifood Supply Chain

In the face of a growing global population and the intricacies of the agrifood supply chain, digital transformation has become a necessity rather than a luxury. The shift from traditional methods to digitalization and automation is vital to enhance efficiency, transparency, and sustainability. By digitizing operations and breaking down data silos, real-time communication and collaboration among stakeholders can be achieved. QR code labels and digital twins, exemplified by DiMuto, facilitate supply chain visibility and data capture from production to distribution. Incorporating technologies like IoT, sensors, and blockchain enables informed decision-making, waste reduction, and increased efficiency. AI and data analytics further contribute by predicting yields, optimizing routes, and tailoring production. Sustainability is a driving force behind this transformation, allowing resource conservation and waste reduction, ultimately leading to a more sustainable food system with environmental and social benefits.

Find out more in this article